Property Tax Assessment Appeals

Counseling for your 2026 Allegheny and Other Pennsylvania County Tax Assessment Appeal

The Allegheny County 2026 Appeal Deadline is now September 2, 2025.

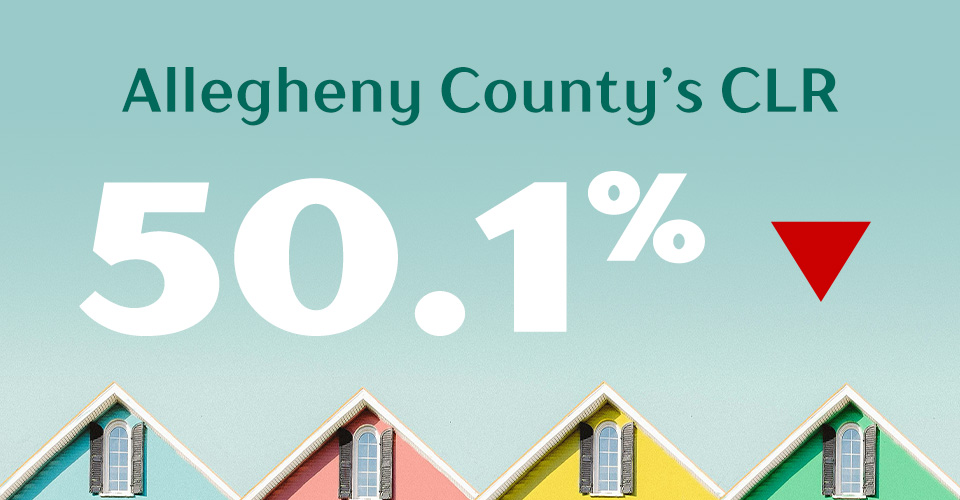

A lower common level ratio (CLR) will go into effect in Allegheny County for tax year 2026, bringing the potential for major tax savings to property owners — and a short window to take advantage of it.

For further information on the potential benefits, and the risks of filing a tax assessment appeal, please read the following documents:

Please fill out the form if you would like someone to follow-up with you, or you can reach out to Jason Yarbrough directly at [email protected] or 412-456-2592.

Frequently Asked Questions

Get answers to some frequently asked questions about how an updated CLR can impact assessed values and property taxes:

Each county in the state of Pennsylvania will determine its own appeal deadline.

The Allegheny County 2026 property tax assessment appeal deadline is September 2, 2025.

For a list of deadlines in other counties, click here.

Every county has a “base year” for tax assessment purposes. Property assessments are supposed to reflect a base year valuation.

The base year for Allegheny County is 2012. The CLR is a ratio which is intended to convert present day market values into base year assessed values.

The CLR in each county is adjusted annually based on sales data selected in their county.

For example, in 2026, Allegheny County’s CLR will drop to 50.1%. Five years ago, Allegheny County properties were assessed at 86.2% of market value. At that time, a property worth $1,000,000 was assessed at $862,000. Today a $1,000,000 property should be assessed at $501,000.

Yes, CLR applies to commercial, industrial, and income producing properties.

When it works to their benefit, taxing authorities chase new sales and seek an increase in assessed value. In doing so, the taxing authorities are essentially asking that a new “snapshot” of market value be taken and the current CLR applied to the purchase price of the property.

No, you must file a tax assessment appeal to get the benefit of the reduced CLR ratio. If you do not file an appeal, no one will file an appeal for you and you will not benefit from the reduced CLR. Taxing authorities only file tax appeals on properties where they believe they can increase the property’s assessed value, resulting in higher property taxes.

Property taxes are based on assessed value. Assessed values are taxed at the millage rates set by your County, school district, and local municipality. Assuming no change in millage rates, a lower assessed value means lower property taxes. Taxing authorities may increase their millage rates to avoid a large drop in tax revenue resulting from fewer assessed dollars. If millage rates increase, each assessed dollar will be taxed more. In a rising millage rate environment, property owners will see tax increases unless they can reduce their assessed value via a tax assessment appeal.

The answer to this question will vary based on each property’s use, market value, current assessed value, improvements made to the property, and the strategies available to obtain a reduction for that property. The attorneys in Meyer, Unkovic & Scott’s Real Estate Group have substantial experience representing property owners with property tax assessment appeals throughout Pennsylvania.

Additional Information

Government Budgets Face Major Disruptions from Tax Assessment Appeals

The Pennsylvania Lawyer, July/August 2024

‘Some Kind of Systemic Breakdown:’ Property Owners Waiting Months for Assessment Refunds that Should Arrive in Just 30 Days

Pittsburgh Post-Gazette, May 16, 2024

No letup: City, school district could be dealing with more building assessment cuts in 2024

Pittsburgh Post-Gazette, April 18, 2024

Unpacking Allegheny County Tax Assessment Appeals: Helping Clients Secure Savings in 2024

The Legal Intelligencer, March 29, 2024

‘A big number’: Allegheny County Council action could trigger thousands of assessment appeals — retroactively

Pittsburgh Post Gazette, January 26, 2023

2023 Tax Assessment Appeal Deadlines Fast Approaching In Many Western Pennsylvania Counties

MUS Client Advisory, July 19, 2022

In 2023, tax breaks could await property owners who file assessment appeals in Allegheny County

Pittsburgh Post-Gazette, June 30, 2022

Owners of Downtown Pittsburgh skyscrapers, other commercial properties could benefit from assessment appeals deal

Pittsburgh Post-Gazette, May 9, 2022

Empty Office Buildings Squeeze City Budgets as Property Values Fall

The New York Times, March 3, 2021

COVID-19 Fallout Could Lead to Lower Commercial Property Taxes

Bloomberg Tax, July 14, 2020

Contact us to see if an assessment appeal would benefit you.

Jason M. Yarbrough

Partner

Jason M. Yarbrough is a Partner and Chair of the firm’s Real Estate Litigation Section, Co-Chair of the firm’s Summer Associate Program, and a member of the firm’s Construction Law, Creditors’ Rights & Bankruptcy, Energy, Utilities & Mineral Rights and Litigation and Dispute Resolution Practice Groups.

Jason frequently represents clients in complex commercial, real estate and construction disputes. His real estate litigation practice includes disputes involving the acquisition and development of real property, landlord tenant disputes, property rights, property tax assessment appeals and exemption proceedings, land use and title disputes, partition actions and foreclosure proceedings. In his construction practice, Jason represents owners, developers, contractors, architects, and engineers in disputes arising out of both public and private construction projects. He has litigated claims in state and federal courts, and against state agencies and the federal government.